Broken Hearts, Empty Wallets: IRS and DOJ Combat Elder Fraud Over $4.89 billion in total annual losses were reported by victims over the age of 60 in 2024. This is up 43% over previous estimates. Typical elder fraud scams include Pig Butchering, in which senior citizens lost over $1.6 billion to

... Continue ReadingAdoption Tax Credit Changes

Adoption tax credits under the One, Big, Beautiful Bill Taxpayers who finalized an adoption in 2025 or started the adoption process before 2025, may qualify for the Adoption Tax Credit. Additionally, there have been significant changes to the tax credit under the One, Big, Beautiful Bill. Here’s an

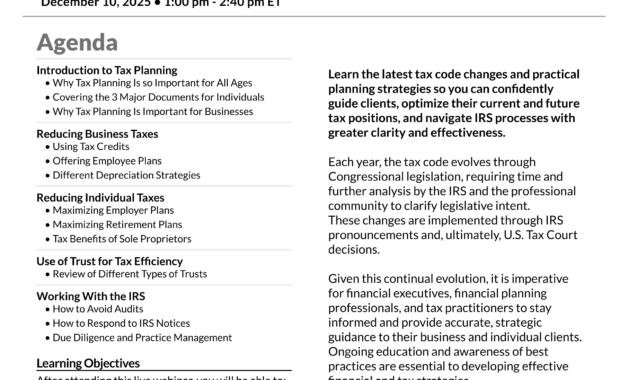

... Continue ReadingNew Webinar! Tax Planning and Legal Tax Reduction Strategies

Tax Planning and Legal Tax Reduction Strategies December 10, 2025 1:00PM EST - 2:40PM EST Leonard Steinberg will be speaking at an upcoming Lorman Education Services live webinar. This program will be of particular interest to colleagues and financial professionals. You are personally invited to

... Continue ReadingCommon questions about the advance child tax credit payments

The advance child tax credit allows qualifying families to receive early payments of the tax credit many people may claim on their 2021 tax return during the 2022 tax filing season. The IRS will disburse these advance payments monthly through December 2021. Here some details to help people better

... Continue ReadingNew Child Tax Credit

To Our Valued Clients: With the recently enacted American Rescue Plan, there were changes made to the child tax credit that may benefit many taxpayers, most notably: The amount has increased for certain taxpayers The credit is fully refundable The credit may be partially received in

... Continue ReadingBusiness Deductions Update

The latest on allowable business deductions For tax years 2021 and 2022, business meals purchased from or consumed in a restaurant have a temporary deduction of 100% (the regulations call for a 50% deduction for business meals). The following chart provides a snapshot of allowable business

... Continue ReadingLike-Kind Exchange Of Property

With a properly constructed Section 1031 transaction, you sell your old property, buy the replacement property, and pay no taxes. The IRS Code Section 1.1031 states that no gain or loss is recognized if property held for productive use in a trade or business or for investment is exchanged solely for

... Continue ReadingTax Day for individuals extended to May 17: Treasury, IRS extend filing and payment deadline

WASHINGTON — The Treasury Department and Internal Revenue Service announced the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days. “This continues to

... Continue ReadingCongress Passes $1.9 Trillion Covid Relief Package Loaded with Tax Provisions

On Wednesday, March 10, the House of Representatives, by a party-line vote of 220-211, passed the Senate's version of the American Rescue Plan Act (the Act) that had been narrowly approved on Saturday, by a 50-49 vote. The House accepted the Senate's version of the Act without change and President Biden

... Continue Reading