Due to COVID-19, the IRS’ People First Initiative provides relief to taxpayers on a variety of issues from easing payment guidelines to delaying compliance actions. This relief is effective through the filing and payment deadline, Wednesday, July 15, 2020. • Existing Installment Agreements – Under

... Continue ReadingMay 5 deadline for VA, SSI recipients who don’t file a tax return and have dependents

VA, SSI recipients with eligible children need to act by May 5 to add to their automatic Economic Impact Payment. ‘Plus $500 Push’ continues. The IRS today reminded Supplemental Security Income and Department of Veterans Affairs beneficiaries to act by Tuesday, May 5 if they didn’t file a 2018 or

... Continue ReadingEconomic Impact Payments continue to be sent, check IRS.gov for answers to common questions

As Economic Impact Payments continue to be successfully delivered, the Internal Revenue Service today reminds taxpayers that IRS.gov includes answers to many common questions, including help to use two recently launched Economic Impact Payment tools. The IRS is regularly updating the Economic Impact

... Continue ReadingCOVID Tax Tip 2020-45

Taxpayers with a filing requirement must file a tax return to get an Economic Impact Payment While most eligible taxpayers don’t need to take any action to receive an Economic Impact Payment, some people will. This includes those who are required to file and haven’t filed a tax return for either 2018

... Continue ReadingCORONAVIRUS EMERGENCY LOANS Small Business Guide and Checklist

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses.

... Continue ReadingCoronavirus Aid, Relief, and Economic Security Act (CARES Act) Q&A:

Coronavirus stimulus check scams are out to swindle you: Do not give out your PayPal account information, Social Security number, bank account number or anything else if someone claims such information is essential to sign you up for a stimulus check relating to the coronavirus pandemic. It's not. It's a

... Continue ReadingIRS Provides More Clarity on Extended Filing and Payment Deadlines

From EISNERAmper LLP Recently, the IRS announced in Notice 2020-18 federal income tax return filing and payment relief in response to the coronavirus (COVID-19) emergency. Its release raised as many questions as it answered. On March 24, the IRS began the process of addressing those questions, through a

... Continue ReadingTAXPAYER SECURITY AWARENESS

TYPES OF SCAMS Receiving Threatening Phone CallsReceiving Unusual EmailsOffers to Collect Tax Payments in PersonRequest for a Specific Type of Payment (like a Gift Card) PROTECTING PRIVATE INFORMATION Physically Protect Your ComputerUse Strong Passwords and Change PeriodicallyUse a Secure

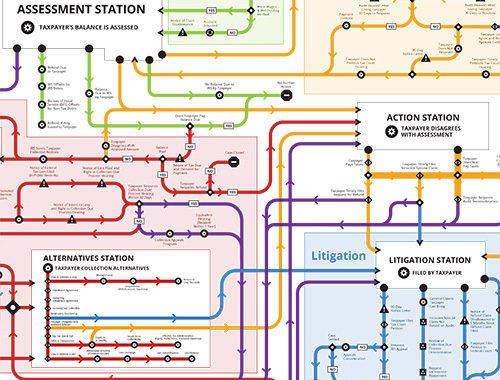

... Continue ReadingThe Taxpayer Roadmap 2019

The map below illustrates, at a very high level, the stages of a taxpayer’s journey, from getting answers to tax law questions, all the way through audits, appeals, collection, and litigation. It shows the complexity of tax administration, with its connections and overlaps and repetitions between stages.

... Continue Reading